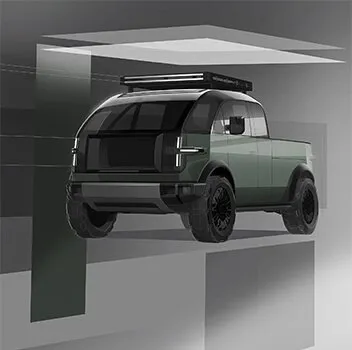

Californian electric vehicle producer Canoo (NASDAQ:GOEV) saw its share price rise close to 14% yesterday as it released prototype images of its new pickup truck.

Canoo pickup truck render 2021 – Source: Canoo Press Kit

#No secrets on Reddit

Thanks to a Reddit leak, news of the new truck began to circulate on Wednesday. Reuters had it confirmed on Thursday and then Canoo made its big reveal. It’s not actually due for release for another two years, but it’s got tongues wagging, nonetheless.

Canoo Pickup Truck – Source: Canoo Press Kit

#What will Canoo’s pickup truck cost?

Canoo is not the first EV company to venture into the truck space. Tesla’s much-ridiculed Cybertruck could potentially launch this year. Then there’s also Ford’s electric F-150 and GMC’s electric Hummer pickup.

The Tesla Cybertruck is expected to start at around $39,900. Meanwhile, Ford’s electric F-150 will cost around $55,000 and the electric Hummer pickup has a starting price of $80,000. Canoo has not yet revealed how much its pickup truck will cost.

#A relatively new EV contender

Canoo launched on the public markets via SPAC last year via Hennessy Capital Acquisition. It’s share price reached a high of $22 after IPO but has since fallen back to around $14, with considerable volatility in between.

The original Canoo vehicle, which was revealed in 2019, bears a modern likeness to a Volkswagon Microbus.

The pickup progresses from this design with a range of utility features. And it’s new and improved overlander version of the new pickup truck resembles a futuristic Volkswagon camper van.

Canoo Overlander, electric pickup truck – Source: Canoo Press Kit

Tony Aquila Executive Chairman of the Board at Canoo said:

“When the working person sees this they go, ‘I can have a better quality of life with this vehicle, and I can get a return on capital.’ And every one of these areas is a space to create a return on capital, which is why we spent so much money to develop the most intelligent truck bed,”

#Future prospects

The electric vehicle business is hugely competitive, and the stakes are getting higher. Canoo has spent a considerable whack on getting to this stage. In 2018 it spent $47m on R&D, $137m in 2019 and $52m in the first 9 months of 2020.

Its most expensive vehicle will sport 600 horsepower, over 200 miles of EV range. Meanwhile, cheaper versions will reach around 100 miles of range.

By using the same brake-by-wire and steer-by-wire system in all its vehicles it streamlines the process and the costs.

All Electric. All American. All Utility. :: 550lb-ft of torque :: 1800lb payload capacity :: 200+ mile range :: Preorders open Q2 2021 :: Deliveries begin in 2023

Get updates when preorders open in Q2 ⚡️ https://t.co/VtBI8Xb1Xs

— Canoo (@canoo) March 11, 2021

Canoo reveals pickup truck on Twitter

Back in 2019 it planned a subscription style revenue stream, but it’s gradually steering away from this with an option to purchase outright.

The subscription model suits some consumers as it provides more flexibility and peace of mind. It tends to include registration, maintenance, insurance management and charging in one monthly payment.

Canoo has ambitious plans, with a future sales target of $2.3 billion by 2025. And at one point even Apple (NASDAQ: AAPL) was interested in buying the company.

Canoo currently has a market cap of around $3.4 billion. And it’s target market includes small business owners and adventurers.

Aquila also said:

The pickup will be aimed at both consumer and commercial customers and has the potential to be a high-volume vehicle, creating the need for a small-scale, highly automated microfactory,

Canoo said it hopes to start taking customer pre-orders for the pickup truck later this year.