#Meet the Longest-Running Dividend Kings

For investors focused on income and consistency, Dividend Kings offer a potential sense of security. These are companies that have increased their dividends annually for at least 50 consecutive years. But a small group has gone even further, delivering annual dividend hikes for more than 69 years. These businesses have not only weathered economic cycles, but they’ve also prioritized shareholders through multiple generations. For retail investors seeking long-term stability, this is a club worth knowing.

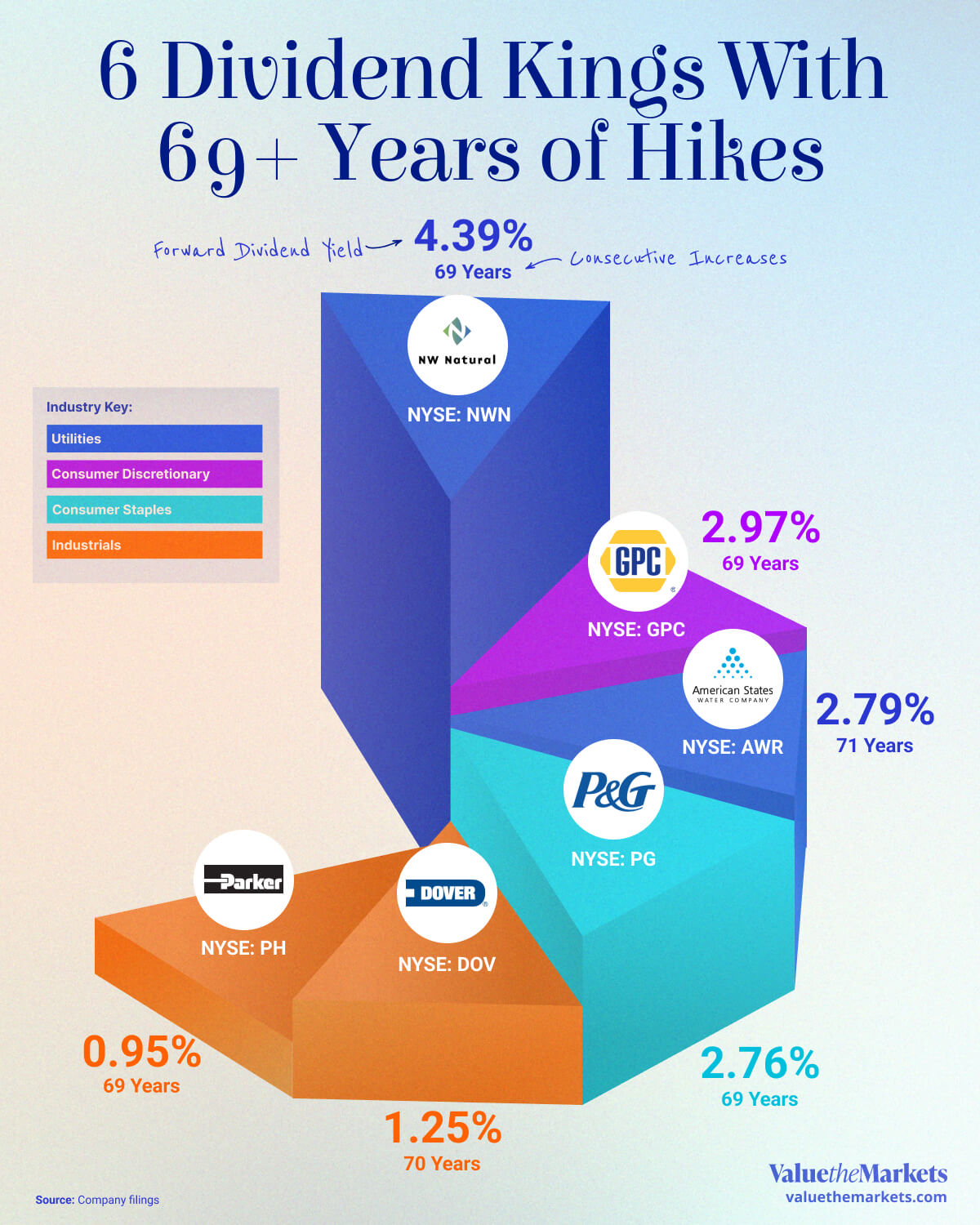

| Name | Exchange / Ticker | Forward Dividend Yield | Consecutive Increases | 5-Year Dividend CAGR | Payout Ratio | Market Cap | Sector |

| American States Water Co | NYSE: AWR | 2.79% | 71 years | 8.70% | 56.28% | 2.7B | Utilities |

| Dover Corp | NYSE: DOV | 1.25% | 70 years | 1.00% | 26.40% | 22.8B | Industrials |

| Northwest Natural Holding Co | NYSE: NWN | 4.39% | 69 years | 0.47% | 75% | 1.8B | Utilities |

| Genuine Parts Co | NYSE: GPC | 2.97% | 69 years | 5.48% | 69.75% | 19.2B | Consumer Discretionary |

| Procter & Gamble Co | NYSE: PG | 2.76% | 69 years | 6% | 61.75% | 352B | Consumer Staples |

| Parker-Hannifin Corp | NYSE: PH | 0.95% | 69 years | 15% | 24.30% | 96.6B | Industrials |

Source: Company Filings

#Why Dividend Longevity Matters for Retail Investors

Consistency Builds Confidence: Companies with decades of uninterrupted dividend increases often show resilience and disciplined financial management.

Income You Can Count On: In retirement or in volatile markets, dependable dividend payouts can support regular income needs.

Strong Signals to the Market: A long dividend track record suggests management believes in the company’s cash flow durability.

Reinvestment Potential: Reinvested dividends from reliable payers can compound returns over time, even in slower-growth sectors.

Defense in Down Markets: Dividend Kings often belong to defensive sectors like utilities and consumer staples, which can offer downside protection.

#The Old Guard of Dividend Growth

Only six U.S. companies have grown their dividend for at least 69 straight years. They span four sectors and share a commitment to steady shareholder returns.

American States Water Co (AWR)

With 71 consecutive years of dividend growth, American States Water is one of the most consistent dividend payers in the U.S. market1. The 2.79% yield may not appear high at first glance, but its 5-year dividend CAGR of 8.7% reflects strong and steady momentum. Indeed, the company explicitly seeks >7% annual dividend growth over the long run.

As a regulated water utility, AWR benefits from a stable customer base and predictable cash flows that help sustain its track record of dividend increases. The company also operates a non-regulated services segment under long-term contracts, which adds diversification. Its dividend payout ratio of 56.28% (as of Q3 2025) means the company pays out just over half of its profits as dividends while keeping the rest to maintain and grow its business. This balance shows that AWR rewards shareholders today without putting future growth at risk.

For investors seeking dependable income and long-term stability, AWR stands out as a reliable and well-managed choice in the utility sector.

Note: Payout ratio shows what portion of a company’s profits are paid to shareholders as dividends. A lower ratio means the company is keeping more of its earnings to reinvest or handle downturns, while a very high ratio can suggest less room to grow or maintain future dividends.

Dover Corp (DOV)

With 70 consecutive years of dividend growth, Dover Corp is one of the most reliable dividend payers in the market2. The company’s 1.25% dividend yield may appear modest, but its payout ratio of about 26.4% reflects a very conservative dividend policy. Dover has historically kept its payout ratio well below 30%, giving it a wide margin of safety for continued dividend payments and strong financial flexibility, which is uncommon for an industrial company.

While dividend growth has been modest, averaging 1% CAGR over the past five years, the company’s low payout leaves plenty of room for future dividend increases as earnings rise. For investors who value stability and long-term reliability, Dover remains a steady and dependable choice.

Northwest Natural Holding Co (NWN)

NWN offers the highest yield of the group at 4.39%, appealing to income investors looking for predictable cash flow. Impressively, the company has increased its dividend for 69 consecutive years3, placing it among the most reliable dividend payers in North America. However, its dividend growth has been minimal at around 0.5% annually, and with a relatively high payout ratio of 75%, NWN has limited flexibility for accelerating future dividend growth.

Genuine Parts Co (GPC)

Best known as the parent company of NAPA Auto Parts, Genuine Parts Co has built an impressive record of 69 consecutive years of dividend growth4. The company currently offers a 2.97% dividend yield, supported by steady business performance and consistent cash flow.

Its 5-year dividend CAGR of 5.48% reflects a solid pace of long-term growth, balancing income and stability. The dividend payout ratio of 69.75% shows that GPC distributes a significant but sustainable portion of its profits to shareholders while keeping enough to invest in its operations and future expansion.

For investors looking for dependable income and proven dividend reliability, GPC delivers both staying power and a track record of steady growth.

Procter & Gamble Co (PG)

One of the most recognizable names in consumer goods, Procter & Gamble has increased its dividend for 69 consecutive years5, cementing its reputation as a cornerstone income stock. The company offers a 2.76% dividend yield with a 5-year dividend CAGR of about 6%, reflecting steady growth supported by its strong portfolio of everyday household brands.

Its payout ratio of 61.75% shows that PG returns a healthy share of its profits to shareholders while keeping enough to reinvest in marketing, innovation, and global expansion. This balance supports both consistent dividend income and long-term business growth.

For investors seeking stability and resilience, PG remains a reliable choice with a long history of rewarding shareholders.

Parker-Hannifin Corp (PH)

A Dividend Aristocrat and Dividend King, also has one of the longest dividend increase streaks in the market, maintaining 69 consecutive years of dividend growth6. The company has a strong record of returning capital to shareholders through both dividends and share buybacks. Often viewed as a high-quality cyclical industrial company, Parker-Hannifin benefits from broad end market exposure and a resilient balance sheet that helps it weather economic downturns.

While it offers the lowest yield on the list at 0.95%, PH stands out for its robust dividend growth, with a 5-year CAGR near 15% and a conservative payout ratio of just 24.3%. This suggests management remains focused on reinvestment, operational expansion, and future dividend hikes rather than immediate income appeal.

For investors inspired by these long-term dividend performers, history suggests that patience pays off. It seems there’s no bad time to invest.

#How to Evaluate a Long-Term Dividend Payer

Longevity alone isn’t enough. Look at the full picture:

Yield shows what you earn today.

CAGR tells you how that income is growing.

Payout ratio reveals how sustainable the dividend is.

Market cap can give insight into scale and stability.

Each of these Dividend Kings offers a different combination of these metrics. The right fit depends on whether you prioritize current income, growth, or safety.

Nevertheless, even Dividend Kings aren’t immune to risk. Warning signs like deteriorating cash flow, rising debt, or unsustainable payout ratios can signal potential trouble. Don’t assume past performance guarantees future dividends, always analyze the fundamentals.

Shell PLC (NYSE: SHEL) had maintained its dividend for over 70 years before cutting it by two-thirds in 2020 during the COVID-19 crisis. The company faced collapsing oil prices and falling revenue, which made its prior dividend payout unsustainable. This underscores the importance of tracking payout ratios, industry pressures, and macroeconomic vulnerabilities, even in seemingly “safe” names.

Plus, total return still matters. Don’t focus solely on dividends. Price appreciation contributes to long-term returns, and some high-yield stocks may underperform if their stock price stagnates or declines.

Dividends are only part of the total return story. See how 2025’s top-performing assets — from gold to Bitcoin — stack up here.

#FAQs

What qualifies a stock as a Dividend King?

A U.S. company must raise its dividend for at least 50 consecutive years. The ones listed here have done so for around 70 years.

Are high yields always better?

Not necessarily. A high yield with no growth or high payout ratio could signal risk.

Can Dividend Kings cut their dividend?

Yes, but historically it’s rare for this to happen. These companies often treat the dividend as sacrosanct, even during recessions.

Is it better to reinvest dividends or take the cash?

It depends on your goals. Reinvesting can enhance long-term returns through compounding, while taking the cash can support income needs.

Are utilities always safe dividend stocks?

They tend to be more stable, but even utilities face risks from regulation, debt, and changing demand. Always check financial health and payout ratios.

Are dividends taxed?

In retirement accounts (like IRAs or RRSPs), dividends are typically tax-deferred. In taxable accounts, qualified dividends are taxed at capital gains rates, while non-qualified ones are taxed at ordinary income rates. This can impact your net return.